Introduction

In the world of medical billing, where the standard procedures for managing insurance denials are well-known. However, if you’re reading this, you’re not satisfied with just ‘standard’. You want to excel, to outperform, and to ensure maximum success in the appeals process. This post is for you – experienced medical billers seeking innovative, clever tactics to take your skills to the next level.

Reasons Why Healthcare Claims Face Rejection

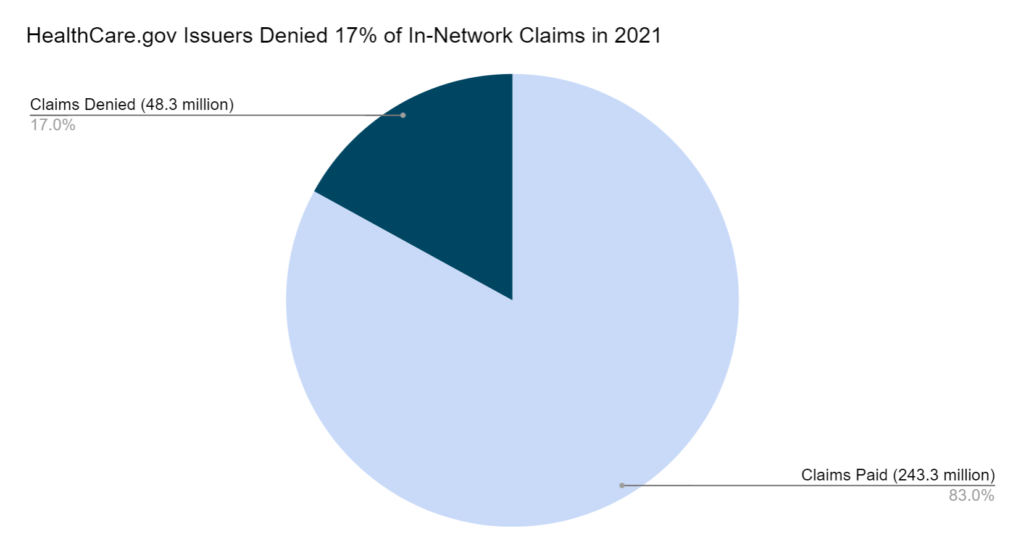

Challenges persist even for expert medical billers adept at claim submission and resubmission. Of the 230 major medical issuers in HealthCare.gov states that reported for the 2021 plan year, 162 reported receiving at least 1,000 in-network claims and show data on claims received and denied. Together, these issuers reported 291.6 million in-network claims received, of which 48.3 million were denied, for an average in-network claims denial rate of 16.6%. Below are well-known reasons for claim denials that even expert billers may encounter:

Source: https://www.cms.gov/marketplace/resources/data/public-use-files

1) Regulatory Compliance Challenges: Evolving healthcare regulations demand constant vigilance. Billers must stay current with compliance requirements to prevent denials arising from unintended non-compliance.

2) Coordination of Benefits (COB) in Complex Cases: Patients with multiple insurance coverages or coordination of benefits across different plans can present challenges. Expert billers need to navigate intricacies to avoid denials related to COB complexities.

3) Denials Related to Specific Payer Policies: Different insurance companies often have unique policies and requirements. Expert billers must be well-versed in the nuances of each payer’s guidelines to prevent claim denials specific to their policies.

4) Data Entry Errors: Even with sophisticated billing systems, data entry errors can occur. Typos, incorrect codes, or system glitches may lead to denials, emphasizing the need for meticulous data validation.

Understanding the Psychology of Insurance Adjusters

First, let’s delve into the psychology of insurance adjusters. They are trained to minimize payouts, so understanding their mindset is crucial. Begin by establishing a rapport with adjusters. Personalize your interactions and remember details about them. This human connection can make them more receptive to your appeals.

Tips:

- Personalize Communication: Use their name, reference previous interactions, and build rapport.

- Understand Their Constraints: Recognize their goals and limitations to tailor your appeals accordingly.

Percentage of Denials Overturn Rate

Estimated at 210 billion dollars in 2009, claims processing was listed as the number two most significant contributor to “wasted” healthcare dollars in the US. Just a decade later, in 2019, that amount climbed to an estimated $265 billion. According to a pre-pandemic American Hospital Association (AHA) survey, 89% of all hospitals and health systems saw a rise in denials over the past three years, with half of the participants surveyed describing the increase as “significant.” Data from Healthcare.gov also confirmed this trend.

In today’s post-pandemic environment, denials continue to rise. 30% of healthcare leaders say that claims denials are increasing at a rate between 10 to 15%, according to the latest Experian Health data. 70% of survey respondents indicated that claims management is more important than ever now that the pandemic is over – reducing claims denials a top priority.

Success Tips: How to avoid claims denial

Challenges persist even for expert medical billers adept at claim submission and resubmission. Below are advanced reasons for claim denials that even expert billers may encounter:

1. Staying up-to-date with the current information

It is of utmost importance to stay updated with the current information regarding claims, especially the policy changes and upgrades that happen in different stages of the claims submission process. Populate’s claim validation process makes it easier for the billers to check and submit the claims without any hassle. Here are a few points the billers need to keep in mind to avoid claim denials:

- Changing Reimbursement Policies: Frequent updates and changes in reimbursement policies can catch even experienced billers off guard. Claims submitted based on outdated policies may face denial. Partner with a billing team that stays up to date on the latest changes.

- Regulatory Compliance Challenges: Evolving healthcare regulations demand constant vigilance. Billers must stay current with compliance requirements to prevent denials arising from inadvertent non-compliance.

- Denials Related to Specific Payer Policies: Different insurance companies often have unique policies and requirements. Expert billers must be well-versed in the nuances of each payer’s guidelines to prevent claim denials specific to their policies.

2. Leveraging Data Analytics

Data is your secret weapon. Analyze denial patterns to identify common reasons for rejections, and use this information to address these issues in future claims preemptively.

Strategies:

- Predictive Analytics: Use software to predict which claims might be denied based on historical data.

- Customized Reports: Generate reports highlighting common denial reasons and use them to modify your billing practices.

3. Advanced Documentation Techniques

Enhance your documentation to make every claim undeniable. Ensure that all necessary information is included, but also focus on the quality of the information provided.

Techniques:

- Detailed Notes: Include detailed notes that justify the necessity of the service.

- Evidence-Based Billing: Use medical studies or articles to justify certain procedures or treatments.

4. Strategic Appeal Letters

Crafting an impactful appeal letter is an art. These letters should be concise, fact-based, and persuasive. Use bullet points to highlight key arguments and include supporting documents as appendices.

Key Elements:

- Customization: Tailor each appeal letter to address the specific reasons for the denial.

- Evidence Integration: Include relevant medical records, doctor’s notes, and studies to support your appeal.

5. Negotiation Skills

Negotiation is an underutilized skill in medical billing. Sometimes, it’s about finding a middle ground where both parties feel satisfied.

Negotiation Tactics:

- Offer Solutions: Propose alternatives that might be acceptable to the insurer.

- Know When to Escalate: Recognize when it’s time to take the issue to a higher authority within the insurance company.

Conclusion

Implementing these advanced strategies is a game-changer in reshaping your response to insurance denials. It goes beyond ensuring claim approvals; it’s about revolutionizing the entire process for enhanced efficiency and effectiveness. For seasoned medical billers like yourself, the opportunity to impact your practice’s financial health is substantial. Embrace these tactics wholeheartedly, and witness a remarkable ascent in your success rate.